Lees-top 10: Het effect van COVID-19 op forecasting

1. The one task the CFO should not delegate: Integrations

The numbers show that when the finance chief is directly involved in identifying potential synergies, transformation and value-creation opportunities, and cultural pitfalls, companies see greater deal success.

2. The State of AI-Driven Digital Transformation

Over the past decade, digital transformation has been changing and re-inventing the way organisations conduct business. Essentially, it is the process of leveraging digital technology to create new or modify existing customer experiences as well as business culture and processes, to meet changing customer and market needs. Digital transformation is a foundational change in how an organisation delivers value to its customers. Here’s where artificial intelligence (AI) is poised to become the game changer…

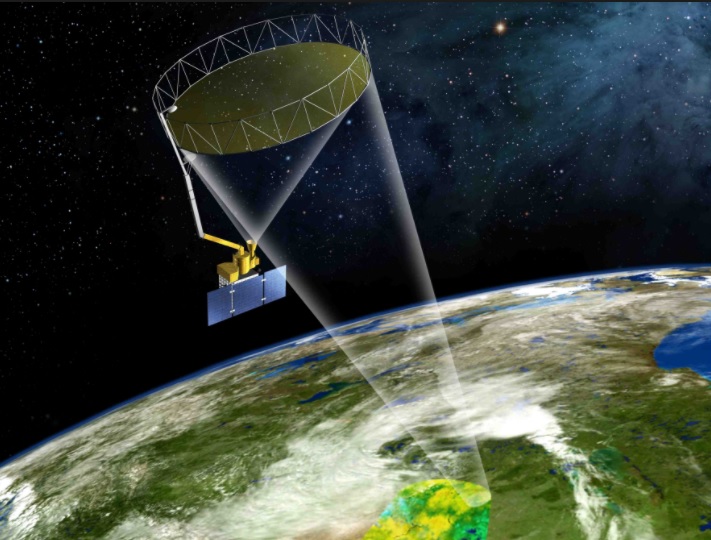

3. Could climate become the weak link in your supply chain?

Questions about supply-chain risks and resilience are now being raised in the context of the global COVID-19 pandemic as well as acute weather events. As climate change makes extreme weather more frequent and/or severe, it increases the annual probability of events that are more intense than manufacturing assets are constructed to withstand, increasing the likelihood of supply-chain disruptions.

4. Capital One Fined $80 Million Over 2019 Hack

Capital One has agreed to pay $80 million to settle charges stemming from the 2019 hacking incident that exposed data of more than 100 million customers, one of the largest attacks targeting financial data ever. In a consent order, the Office of the Comptroller of the Currency said it assessed the civil penalty based on the bank’s failure to establish effective risk management prior to migrating information technology operations to the cloud, and due to the bank’s failure to correct deficiencies in a timely manner.

5. The pandemic's effects on forecasting and budget allocation

At a time of heightened uncertainty, it can be helpful to see what day-to-day strategies your peers are using to keep afloat. A series of webcasts this summer focused on how CFOs and finance leaders can help their organisations increase resiliency and jump-start growth in the current environment and offered a view into tactics being employed.

6. Metric of the Month: Uncollectable Balances as a Percentage of Revenue

In a chaotic business environment hampered by a global pandemic, many vendors, suppliers, and other businesses are holding “bad debt” in the form of payments owed that will never be collected from customers. When does a finance chief know his or her company is holding too much bad debt, and what can be done about it? This month, we dig into uncollectable balances to explore how much leading companies hold relative to their revenue and explore the strategies they carry out to keep uncollectable balances as low as possible.

7. 7 Powerful Habits of People With High Emotional Intelligence

Think about the people you know who always seem to get what they want. Are they self-centered? Are they their own best advocates? When you think of their success, do you feel happy for them? Do you admire them? If you don't, let's assume for our purposes that other people don't admire them either. So how does someone become successful while consistently making enemies?

8. 8 Ways Managers Can Support Employees’ Mental Health

Uncertainty breeds anxiety, and we are living in uncertain times. Between rising numbers of Covid-19 cases, questions about whether or not to reopen economies and businesses, the ongoing protests in the wake of George Floyd’s murder, and the economic fallout of the pandemic, we don’t know what will come next. And that’s taking a toll on our mental health, including at work.

9. Google's Remote Work Policy Has 9 Great Tips You Should Definitely Steal Today

Google spoke to ore than 5,000 employees to discover these remote work best practices. They provide a lesson in emotional intelligence.

10. Managing cross-cultural diversity in finance

When I started my first regional role as CFO with telecom Nokia in Shanghai in 2001, headquarters' expectations and mandate were clear: Beyond the finance deliverables, my assignment was to build relationships between a Western-cultured organisation and the teams from Asian countries, especially China; to build teams that share the corporate culture; transfer expertise; and grow selected local talents.