Lees-top 10: Ontmoet je toekomstige CFO, strateeg en futurist

1. Resources for staying relevant as finance changes

All around the world, the business environment is undergoing significant change that will not let up anytime soon, given ongoing global economic uncertainty and technological advances. To stay relevant now and into the future, and to maintain a key strategic position within companies, CFOs and finance functions must evolve. A new toolkit launched by the International Federation of Accountants (IFAC) provides finance professionals the resources to figure out how. The series includes:

2. A Corporate Governance Paradigm Shift

The sustainability of conventional corporate governance models has recently come into question. Directors are living in the midst of intense competition in a business environment disrupted by shifts in technology, macroeconomics and geopolitics. As a result, some of the critical questions that boards need to confront are: What transforms the business environment today? What are our risks and opportunities? Can directors continue to be effective without considering recalibration and renewal?

3. Why Isn’t Your Transformation Showing Up in the Bottom Line?

Transformation success rates vary widely. Finance can make a big difference by articulating and validating the link between transformation and value.

4. Managing team conflict in digital transformation

While digital transformation is touted as an important journey that brings many benefits, its success rate is low, not only because of the complexity coming from legacy systems but also because of a lack of measures to prevent tensions between the teams involved.

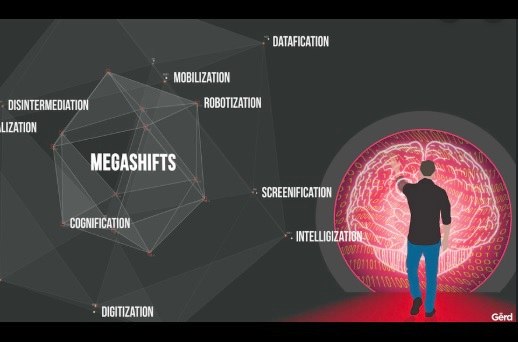

5. Meet your new CFO: a futurist and strategic business partner

Prior to the onset of digital transformation and recent technology advances, a Chief Financial Officer (CFO) was captain to an organisation’s ship charting a company’s finance journey. In this traditional role CFOs had a clear direction for where to navigate based on past experience. They rarely steered the ship into murky waters outside of their conventional duties of financial planning and analysis.

6. Outside Board Service Boosts Inside Accounting Quality

Few CFOs serve on boards of directors of outside companies. That probably reflects concerns about the amount of time board service entails, according to a new study, especially since a majority of finance chiefs on outside boards are members of the time-consuming audit committees. Yet the study concluded that, far from interfering with CFOs’ ability to provide sound financial reporting for their employers, service on outside boards actually enhances it.

7. Developing Better Commercial Decision Making In Your Employees

Although good commercial decision making is often spoken of as if it were some mysterious quality that only certain individuals possess, it can be treated as any other skills set – as long as we use the right tools.

8. Elon Musk’s chaotic business strategy for Tesla is actually brilliant

Few companies have attracted as much praise, derision, skepticism, and enthusiasm as Telsa Motors and its founder Elon Musk. Having interviewed Elon Musk and the Tesla leadership as part of my research, one of the questions I’m asked most frequently is: How can you make sense of Tesla’s wild strategies? The latest example is the move to create a “Gigafactory” for car batteries just outside Berlin.

9. How to overcome resource allocation challenges

“Executives are not bad at running businesses, but they invest too much in their below-average business lines and too little in their above-average ones,” said Greg Milano, the CEO of Fortuna Advisors, a consulting firm in New York City.

10. The 20 Best Business and Leadership Books of the Year, According to Amazon

The holiday season is just about here and my personal favorite aspect isn't the family gatherings, delicious meals, or festive good cheer (though those are all nice). No, it's the best books of the year lists.